Wages for maternity leave. Tax exemption on EPF Withdrawal.

Salary Segments That Can Reduce Employees Tax Liabilities Sag Infotech Salary Segmentation Tuition Fees

The Employees Provident Funds and Miscellaneous Provisions Act 1952 EPF Act defines basic wages to include any other allowance similar to dearness allowance house rent allowance etc payable.

. A Actual HRA Received. Hello Everyone As we all are aware that SC has amended a New Guideline that EPF Deductions will be done on Gross Salary excepted HRA. Self Reliance with Integrity EPFO won the Platinum Award the highest award given by Honble Minister Information Technology Govt.

Any traveling allowance or the value of any travel concession. Dividends generated from EPF are also exempted from tax. There are always some doubts that whether a particular allowanceemolument is to be included for calculating the ESI contribution by the employerSo we have summerised a list of major allowance wages break up which is to be excludedincluded while calculating the ESI contribution.

Salary Basic DA if part of retirement benefit Turnover based Commission. Only tax exempt allowances perquisites gifts benefits listed above No. However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference.

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. Exemption is granted to an establishment covered under the Act i if the rules of its provident fund with respect to the rates of contribution ar not less favorable than those specified in Section 6 of the Act and ii if the employees are also in enjoyment of other provident fund benefits won the whole are not less favorable to the employees than the benefits provided. However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope.

Wages for half day leave. Any person who has attained the age of seventy-five 75 years. Allowances except a few see below Commissions.

Persons Obligated To Contribute. The Employees Provident Fund EPF or commonly known as Kumpulan Wang Simpanan Pekerja KWSP is a social security institution formed according to the Laws of Malaysia Employees Provident Fund Act 1991 Act 452 which manages the compulsory savings plan and retirement planning for private sector workers in Malaysia. Wages for study leave.

Of India on the third anniversary of UMANG App The EPFiGMS services is available in UMANG Platform EPFO won the SKOCH Gold Award 2020 in the Digital Governance Category EPFO Helpdesk is. So that I can prepare Salary Structure accordingly. 3An employee can avoid TDS by submitting a 15G15H.

Any travelling allowance or the value of any travelling concession. The payments below are not considered wages by the EPF and are not subject to EPF deduction. Gratuity payment given for excellent service Retirement benefits.

Retrenchment lay-off or termination benefits. Except for the persons mentioned in the first Schedule of the EPF Act 1991 you are liable to pay EPF contributions in respect of any person whom you have engaged to work under a Contract of Service or Apprenticeship. Allowance except travelling allowance is included in the definition of wages under the EPF Act.

Others allowances perquisites gifts benefits which are exempted from tax but not required to be declared in Part F of Form EA are as follows. BEPF is a great way to get someone other than yourself namely your employer to contribute to your retirement. Independent India 75.

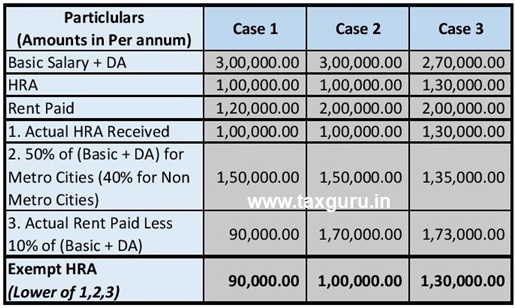

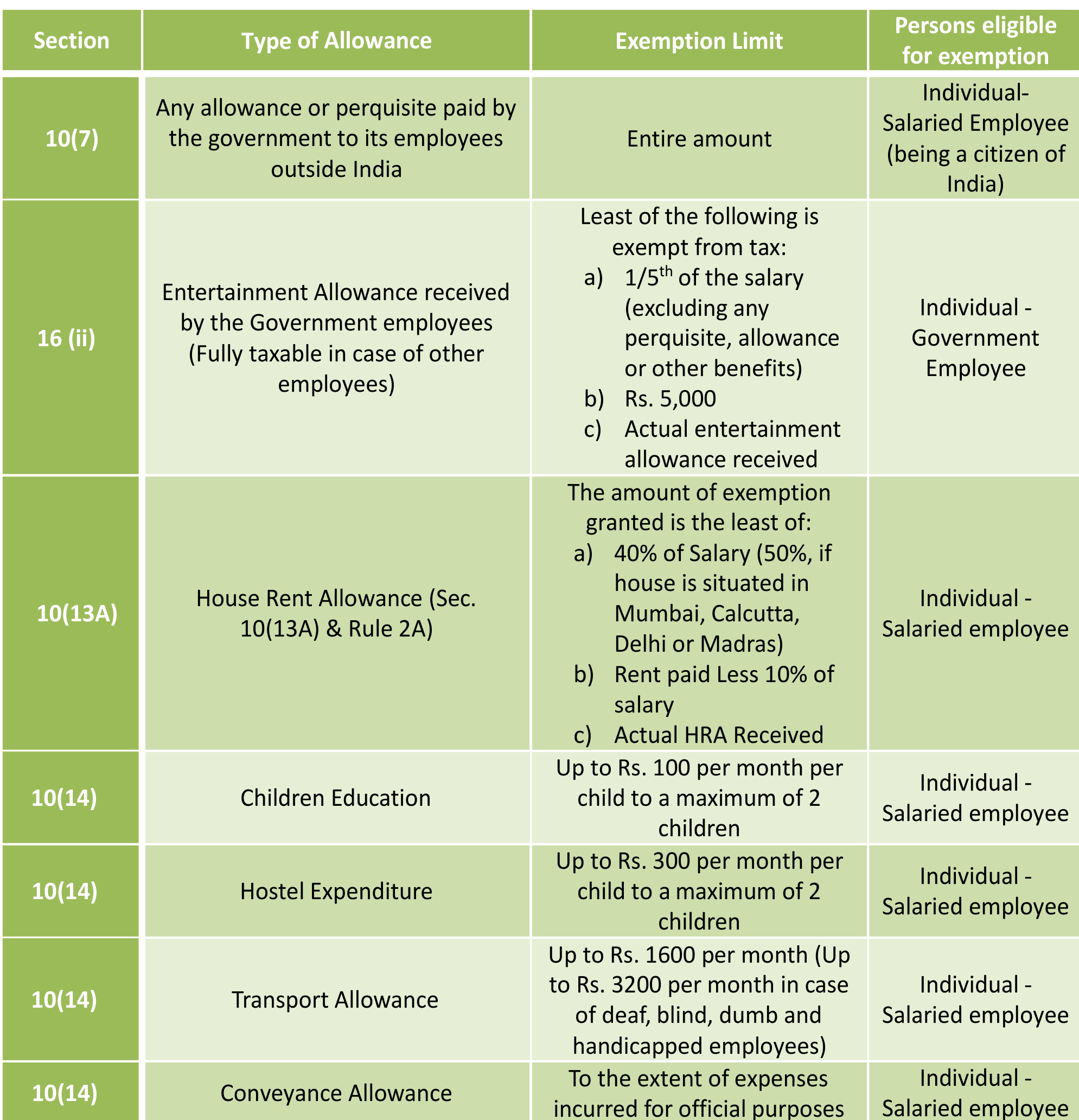

It excludes dearness allowance houserent allowance overtime allowance bonus commission or any other similar allowance payable to the employee in respect of his employment or of work done in such employment. 2If an employee withdraws less than Rs50000 before 5 years of service then there is no TDS on Withdrawal. 1013A House Rent Allowance Sec.

Any other remuneration or payment as may be exempted by the Minister. Payment in lieu of notice of termination of service. Payments Exempted From EPF Contribution.

Membership of the EPF is mandatory for. Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them. Payments which are not liable for EPF contribution are-.

Employees Provident Fund and others Madhya Pradesh High Court Whether Transport allowance HRA Attendance incentive Special allowance Canteen allowance and Lunch allowance paid by the employer is covered under basic wages for the purpose of calculating provident fund contribution. Service charges tips etc. Epf deduction after supreme court ruling - allowance are basic da hra conveyance medical child and special allowance Which allowance are not consider in epf deduction - pdf download Epf contribution clarification wrt hra conveyance allowance medical allowance.

Retrenchment temporary lay-off or termination benefits. Among the payments that are exempted from EPF contribution include. Allowance except travelling allowance is included in the definition of wages under the EPF Act.

Other contractual payments or otherwise. Basic salary is. 1 to 9 are required to be declared in Part F of Form EA.

All cash payments by whatever name called paid to an employee on account of a rise in the cost of living house-rent allowance overtime allowance bonus commission or any other similar allowance payable to the employee in respect of his. Courts will consider factors such as whether the allowances are a fixed sum. The authority conceded that Washing allowance.

For example your employee provident fund EPF is deducted at 12 per cent of your basic salary while the amount of tax-exempt gratuity or leave encashment also depend on it. 1If an employee completes 5 years of Service then there is no TDS for withdrawal from EPF. The payments below are not considered wages by the EPF and are not subject to EPF deduction.

In this regards I would like to know which other Salary Heads are exempted from EPF Deductions. CEPF contribution is that it qualifies for tax deduction by way of personal relief. 1013A Rule 2A Least of the following is exempt.

Cpf employee state insurance epf esi esi contribution esi. Service charges tips etc Overtime payments. Hoping for your favorable responses.

B 40 of Salary 50 if house situated in Mumbai Calcutta Delhi or Madras c Rent paid minus 10 of salary. Payments Exempted From EPF Contribution. For the below cases there is no TDSTax deduction at source.

Payments Exempted From EPF Contribution. As per the EPFO Act PF does not cover certain specified exclusions like cash value of any food concession.

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Supreme Court S New Rule To Calculate Pf Contribution Legawise

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Leaving India To Become An Nri Here S What You Do With Your Pf Account

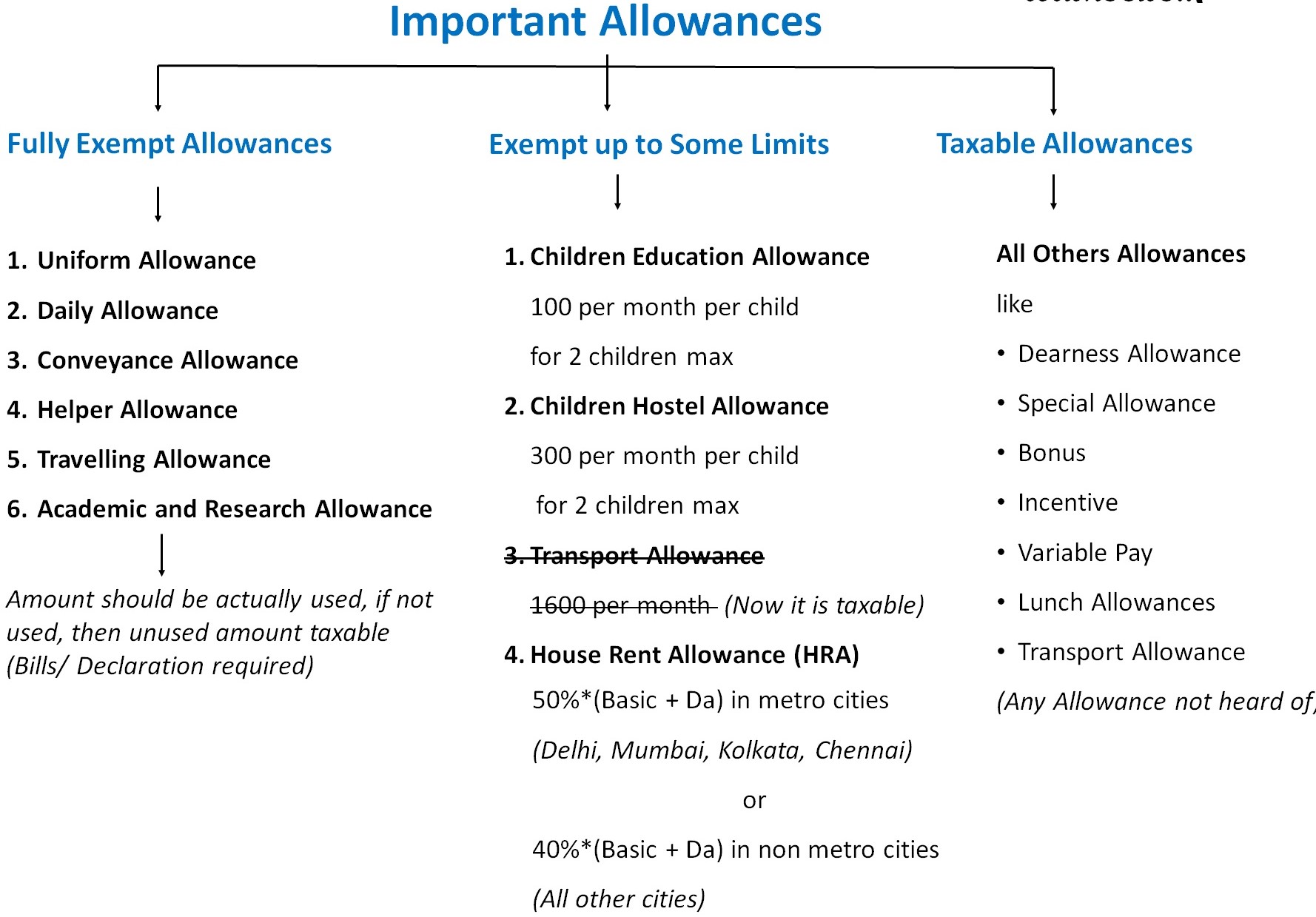

All About Allowances Income Tax Exemption Ca Rajput Jain

Pf Provident Fund On Special Allowances As Per Supreme Court Youtube

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Allowances Exempt From Tax For Salaried Person Most Useful Planmoneytax

Understand Salary Breakup In India Importance Structure And Calculation Asanify

Salary Income And Tax Implications For Fy 2020 21 Ay 2021 22

Post Budget Tax Math Should You Shift From Epf To Nps Now Mint

All About Allowances Income Tax Exemption Ca Rajput Jain

Bt Insight Looking For Ppf Like Benefits But Higher Returns Here S What You Can Do Businesstoday

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Pf Contribution On Allowances How Employees And Employers Will Get Impacted Find Out The Financial Express

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

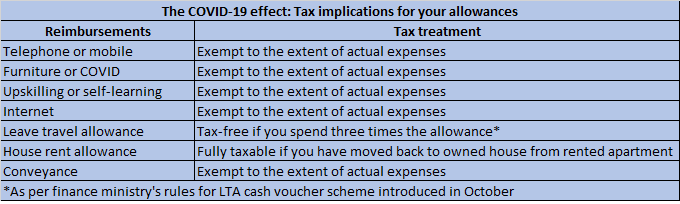

Work From Home Here Is How Reimbursements And Allowances Will Be Taxed

All About Allowances Income Tax Exemption Ca Rajput Jain